*TURKEY'S CENTRAL BANK RAISES OVERNIGHT LENDING RATE TO

12.00%

*TURKEY'S CENTRAL BANK RAISES BENCHMARK REPO RATE TO 10.00%

So Turkey raised rates quite considerably and a full list can be seen here

|

| CBRT rate hikes, HSBC |

As expected the TRY caught quite a substantial bid, moving from 2.25 to around 2.15, not too bad. However there was one overarching problem with this, the substantial rate hike which accounted to about 225bps would severely damage the macroeconomic picture. That is on top of an already slowing economy so it really won't end well, but they had little choice... FX reserves are under $40bn and trying to talk the TRY higher failed many times.

So what what remembered was that this was the CBRT's last move, they couldn't realistically put rates up again, and couldn't really intervene directly. As such the TRY really struggled giving back all the days gains to trade back towards pre-CBRT levels

|

| USDTRY 2 day tick |

The market somewhat settled down, with USDTRY trading around 2.24 (stopping out HSBC after just 12 hours)

@UlasAkincilar @katie_martin_FX pic.twitter.com/JvLjhDhVKr stop was 2.24, now price touched that some places(on reuters), others came very clos

— Jeremy W-Smith (@JeremyWS) January 29, 2014

At this point the days move was already incredible, but what came next was utterly ridiculous.

*SOUTH AFRICA RAISES BENCHMARK RATE TO 5.50% FROM 5.00%

The market was a tad surprised to say the least with 25 of 25 economists expecting no rate hike. This however (much like BoE in 1992) made traders interpret the recent hikes as weakness on the part of both ZAR and TRY which both immediately started to tank.

|

| USDZAR |

The USDZAR reversed the initial spike lower on higher rates and proceeded to move 3% upwards, and over 4.5% from the days low (post CBRT)

This fear spread to all the asset classes and quickly we saw the USDTRY trade up to 2.32, causing risk off across the market, ES dropped, Bond were bid, JPY was bid etc etc.

|

| ES white, TRYUSD yellow |

|

| USDRUB 5yr |

Not just RUB, but even the stronger (CA surplus EMs) ccy's sold off with the HUF down 1.5% vs. the EUR and PLN down 0.5%

All things considered, I really don't see this action today being a solution to the problem, it won't fix the structural deficit for turkey, it won't encourage Speculators to buy TRY (and could like with BoE 1992, cause the market to test the central bank and destroy the ccy) and finally it will hurt the macroeconomic picture for TRY.

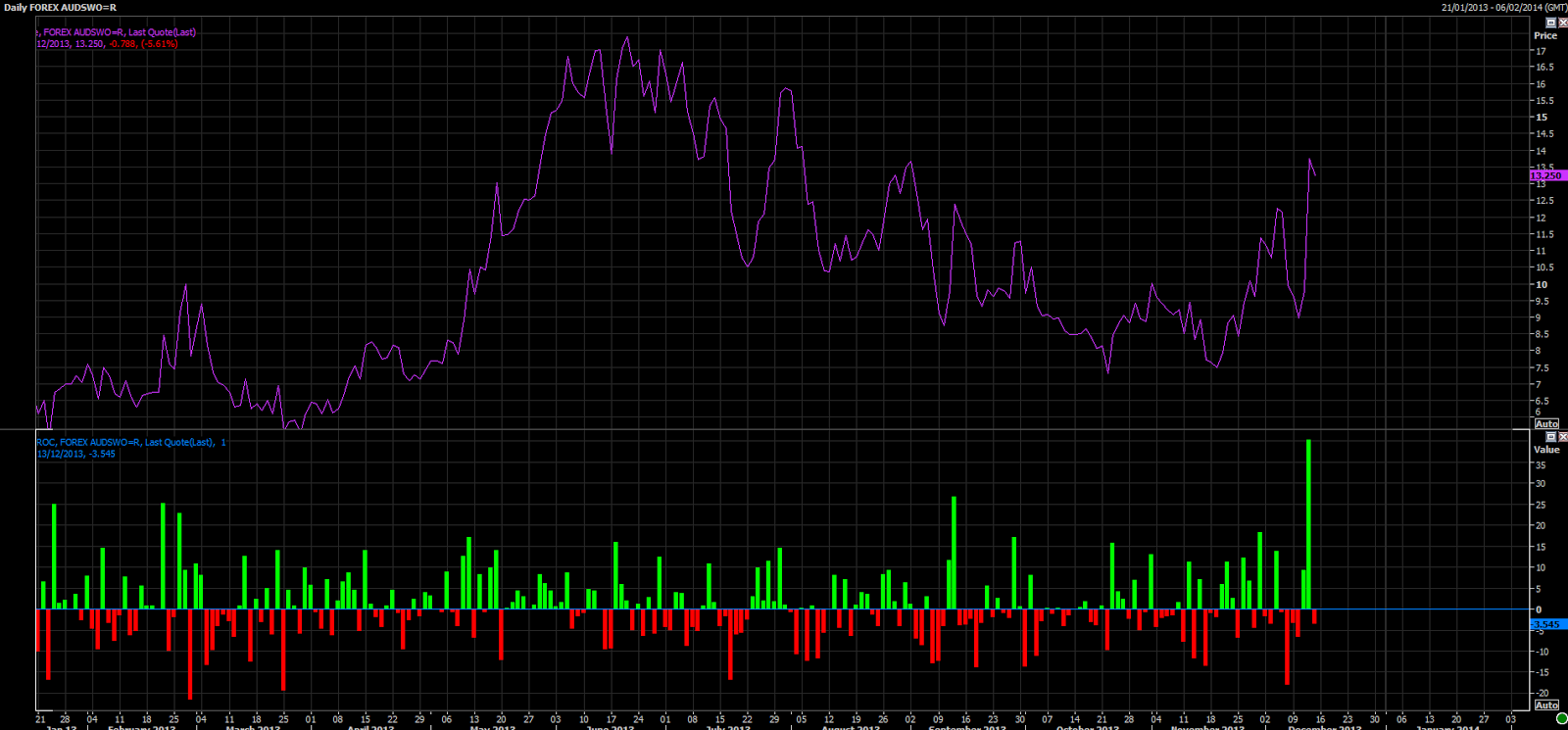

In summary, today was the largest ranged day for over 5 years with around 7% from high to low, based on spot. It also pushed the 1 month IV to its highest since 2009

|

| USDTRY range |

|

| TRY 1 month Implied Vol |