Hey all... its been a very very long time without a post... I was never allowed too... but that's changed... so I'm going to quickly share some thoughts on some markets as we start 2024... as always with these things, dont take it too seriously and do ur own work before you make a trade..

Anyway,

2023 brought us narrative cycles that changed from extreme to extreme, every alternate month. And all that was left at the end of it was a 30yr Yield aggressively unchanged, Stock markets at record highs, credit spreads close to tights and uncertainty (VIX) seemingly a thing of the past.

Many explanations given as to why 2023 didn't go as many predicted, and theories to rationalize the resilience; be it the Fiscal Deficit, Slower monetary lags, accumulated savings or even just the recovery from the pandemic shock.

In this post, I am not going to dwell on explaining what has happened, nor am I going to try and predict what will happen next… You have plenty of Bank strategists who will get it wrong instead!

I am just going to work through some thoughts on what the markets are telling me now, what scenarios are in the price, and where there may be trades to take for those that disagree on which path 2024 takes.

So starting off with Monetary policy, and firstly, the path for the Fed. With Powell’s Pivot coming in the December FOMC the market has rushed to price in close to 150bps of cuts in the coming year, bringing policy from 5.30% down to 3.8% by Dec24, before settling at 3.25% out the curve. With this, the conversation has drastically shifted since Q3 ‘23 from “will the fed cut”, to “when will the fed cuts'' and then into ‘24, “how far will the fed cut”.

Here we have the path for the SOFR, plotted with the option implied breakeven. Without trying to get too cute about it, it's going to be hard to properly monetize a view that sits within these bounds. When we think about what this shows us, it's clear the market has finally removed the tail to further hikes from the Fed. It’s almost a *certainty* that rates will not be sustained at >5% for any meaningful time. On the other end of the distribution, we see that the market is unwilling to meaningfully price sub 2% rates, or a return to the “old new world” (ZIRP).

Removing the tail to >5% FF is clearly a positive for markets and risk assets, and with recent Fed commentary, it seems the hurdle to bring this back into the discussion is extremely high.

This is all well and good, nothing I am saying here is at all controversial. Not least because this is now how the Fed is guiding us. They are now communicating that, with the sustained drop in inflation, keeping policy rates unchanged will be considered marginal tightening. With the running rate of PCE (3-6mma they love to quote) currently at 2%, and the continued “vibescession” in the air (asurvey data), the FOMC has correctly determined that it's the end of its 2yr long program of tightening.

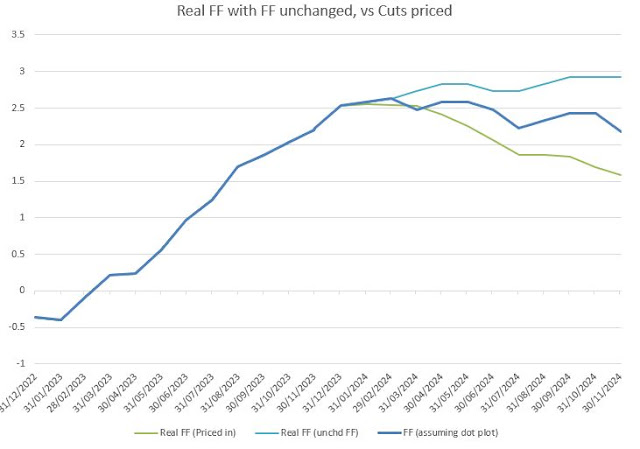

As such, a normalisation in policy will be required to keep the Real fed funds curve stable, (at the current level of tightness) If measured using FF - Core PCE, then the current stance of policy is set at 2.25-2.5% Real. As we look into 2024, and if the forecasts play out for PCE , then if the Fed do not act, the real FF in 1yrs time will be nearer 3%, somewhere between 2-3 additional hikes. It’s now clear why the Fed are forecasting 3 cuts next year, this is with the view to keep real FF broadly stable. And as such, barring any drastic changes on the price outlook, the ceiling for rate cuts is sensibly 75bps.

With 150bps of cuts priced into the curve however.. We not only a see normalisation of nominal FF, but a loosening in real terms... to the tune of about 75bps (ie the 6 priced vs 3 from the dots)

This can be argued as approximately fair, as of now, depending on where your expectations for the US and Recession's this year land. If you do believe that the Fed will be placed into a scenario later this year, where growth has slowed substantially and the labour markets have meaningfully weakened, the Fed will clearly need looser policy. You will certainly require more than 75bps of “real easing”.. Likely needing a Real FF south of 1%.. And thus you will see closer to 250bps of cuts needed to get us there.

(However we note that a FF around 2.75% by Dec24 still falls within the bounds of what our option probability fan chart shows us.)

But there is a time decay associated with this view... a steady economy/labour market, will see us continuously can-kick both the timing and depth of the cutting cycle as we traverse the year.

Data remains far too resilient to be currently expecting a recession, and as we pull to par and take out those cuts, the negative carry of being long the front end will start to seriously burn. Dragging the curve higher, with the market questioning at times (tho likely to no avail) that policy is not tight enough. (replaced with just longer at current levels).

Put simply, if we assume 3 cuts to be the minimum (its not), and circa 10cuts needed to respond to a <meaningful> slow down (tho it'll be 4-5 bigger cuts to bring us 250bps lower).. To receive the front end here with 6cuts priced you need to be just shy of 50% confident that the US will experience a severe enough recession that forces the Fed to actively loosen policy.

Now again, I'm not gonna sit here and say one way or another whether that's gonna happen… but economic momentum is still broadly strong, and with global regions (Europe/China) likely near their own nadirs, it’s neither an easy, nor cheap bet on this outcome.

Whilst there has been a slowing in Labour markets, if there is one lesson corporates will have learnt post Covid, is that letting go of staff may cause even more problems when you need to re-hire later on… perhaps the bar for that major labour market weakness is likely higher than a “typical” downturn…

AND we will still need to deal with the balance sheet in this outcome. In the past, the Fed has used this as the first lever, but its recent experience with starting the tightening cycle contingent on the ending of QE in '21 cost the Fed valuable time in responding to the inflation wave, and they know this. It's definitely possible to see normalisation cuts, whilst QT continues (or at least slows).

A quick look at market implied forward real yields and we have settled with 1.5/1.75% across the entire spectrum as the appropriate real yield.. if/when the Fed really needs to respond to the data, these will be meaningfully lower... and in the meantime, the fed told us they are capped at ~2.5?

So whats the trade?

Steepeners are clearly the most popular macro expression.. And to be honest, they seem inviting.. The Fed will cut… The Fiscal is fucked… Curves should steepen!

And im sure they eventually will, but the carry to hold these will be painful for many and almost certainly a chop fest (as has been the case in Q4 ‘23).. Timing is critical, and chances are you can be patient to get into these.

So as we stand right now:

-even if the data tells you there are no more hikes..

-even if the Fed is telling you it sees 75bps of normalisation…

-the market is still asking 150bps as the hurdle for the year for your steepeners to perform...

I’m not sure the data is anywhere close to leaping that just yet…

To play a similar idea (fwds in the belly are too high) + that they should be pricing a normalisation to the 2-3% range rather than 3-4%, I have preferred the front end flatteners… leaning against the cuts in the H1’24, and playing for deeper cuts into 2025+, this has been the core risk in my book since the summer of last year..

** quick note here... many smarter people than I tend to push back and tell me that the Fed only has a window to cut in ‘H1 as the US election starts to muddy the waters.. And yes I’ve seen the historical analogues, yes I understand the arguments but no I do not think this is a strong enough reason to be in on imminent Fed loosening of real rates.**

The benefit of this position is the carry profile it offers, especially in lieu of the current data that we see.. But of course, the true distinction between the two choices (which ultimately both playing for the same end result of Receiving the belly) is that one is Long Vol (steepener).. the other is Short vol… And the risks that come with those two distinct profiles.. (ie if the Fed truly needs to cut, no reason they can't be 75/100bp steps..)

If we run a little thought experiment and try to value the different points on the curve in this eventual recession scenario.. How is it going to look? lets consider the 10yr point having a real yield somewhere close or lower than 0.5%...and breakevens likely around 2%.. puts our 10y yield somewhere 2-2.5%.

Ok... so... for our 2s10s (at -40bp, but crucially +15bp 1yr fwd) to be performing, we are needing the fed to cut well past 2%.. meaningfully more than priced..and even outside the realm of the option distribution... at this point, if this is the outcome you need its probably just better to own sofr call spreads...

The steepener is long vol.. It's not just owning the tail of the sooner/deeper recession… But also *could* perform if we see a re-acceleration of growth, sticky wages and potentially any topside risks to input prices (geopol etc).. so whilst i've hated on steepeners.. they *can* still work in this world only if we assume the fed never hikes again and that there only possible response to data is chanting "higher 4 Longer"... This is the boogeyman of the bear steepener that we saw last summer.

To hedge my core flattener against the risk of a bear steepener type move, i've re-engaged with puts in US long end at the turn of the year... the market seems incredibly overweight fixed income again, and with the data not cracking, too much priced, and a ton of issuance coming, it seems too rich.

Global Rates

So how does the rest of the world look? Below we chart (somewhat messily) the main Global CBs, and the quantity of rate cuts priced into ‘24 and ‘25…

Of course, they all have very different starting points, and many EM’s (much like the tightening cycle) have begun their journey before the fed. But the broad slope remains the same for all, 2024 is where the majority of cuts are, and 2025 flattens off dramatically.

Looking at these from the same perspective as the fed, lets see how spot Real rates, and the market implied (vs fcast) 1yr fwd real rates compare.

We see a very mixed picture , the US, EZ price the somewhat “fair” probabilistic loosening over 2024, with Real yields dropping 75bps or so, but even across the G10 landscape, the view is very different. The UK, Aus, Norway all stand out with marginal tightening in real terms… (with only 100, 75, 120bps of nominal cuts priced respectively)..

Emerging Markets are very mixed, with the Latam CBs drastically normalising their (arguably) way too high real rates, and the typically prudent CBs of the CNB and BOK see a slight relative tightening.

There is a lot of nuance here though… all these CBs here have different mandates, different reaction functions and different asynchronies along their own cycles.

The point is, when looking into front ends as a tool to play for the worlds 2024 may turn into, we should be careful with which curve to pick. You might end up getting the call right for the US, and not monetising it at all.

My quick thoughts to these curves, without elaborating further, are that HUF/ CLP price a bit too much, and that KRW/BRL/CZK price too little.. (many reasons for this, wont get into it here..)

Global rates correlation has only increased in the post covid world, something that as the impacts wash away, should diminish.. But for now, if one agrees that US Front end are a touch rich, patience will be rewarded, and there will be far better entry opportunities for the fundamental receivers into Q2/3..

Interestingly, while the Rates market suggests a ~50% likelihood of a meaningful recession, this sentiment is not as evident in the credit market with CDX in $ HY merely ~360bps and IG ~60bps. . This divergence is noteworthy as it indicates wildly differing perceptions about the economic outlook.

Following the initial shock caused by last year's banking crisis, there was a notable decrease in cross-asset volatility as we climbed the wall of worry (ex a minor Long end hiccup in sept/oct).. This sucked money into the credit spectrum, baited by the prospect of high total returns.. Culminating with spreads ending the year basically at the tights since the tightening cycle began. Combined with a large rally in UST, we saw a considerable re-pricing lower of costs associated with corporate and sovereign funding.

HY & select EM Sovs have been presented with a golden opportunity to refinance. in Jan24 we should expect them to make the most of it with sizable amount of issuance among the crappiest of names.. (turkey CDS traded sub 300 guys... come on now..)

IG does looks very different.. With many stronger balance sheets than countries, IG treasury departments did a superb job of terming out debt at low yields/spreads post Covid (much like the household balance sheet did)... and whilst there will of course be a beta, I don't have too much concern over IG even in the more meaningful recession scenario…

One major trend we’ve seen also, and something that just feels like a car crash waiting to happen is “Private Credit”... not sure I’ve gone a day without hearing about it.. It's incessant.. and after Blackstones/Apollo’s shocking Xmas videos, I think we can all join together and pray that there is some form of Karma in the world..

When considering valuations.. Realised default rates are broadly speaking low, albeit slowly rising. Perhaps currently around 4%. Forecasts for this are set to rise modestly to around 5-5.5% for 2024, which (given a range of fair recovery assumptions) does not make HY spreads at 350-400bps mispriced in any meaningful way… However in a typical recession (whatever typical is) , default rates are historically observed to realise more like ~8-14%… if what the rates markets are pushing for comes true, there are a lot of accumulated credit positions that may start to sweat and CDS hedges needing to be placed…

I could talk now about equities at all time highs, valuations blah blah, but I won’t.. I'll spare you your time.. But I know that Credit won't sell off if Equities don't... what i do know is that I will lose less if I'm wrong.

As always, using CDS as a macro instrument is functionally just SPX puts in disguise.

Ok so what about FX

2023 was, on the surface, a pretty dull year for FX.. EUR traded in a 7 fig range.. Generally speaking monetary policy cycles were synchronised, and with no major economic divergences, we saw a distinct lack of vol!

Under the hood however, we saw a major dispersion. And Whilst G10 was fairly bounded, the low vol year saw a substantial drift in relative performance as the year progressed.

So what do you do if vol is low in FX? The FX carry trade!

If you came into 2023, and just sorted by Yield, you did pretty amazing just in spot terms alone... Add in Carry and boom, what a year!

Probably one of the best in history (at least my career) for the monkey brain FX carry strategy.

Whilst there are a few anomalies (Switzerland: SNB FX flow / Safe haven.. South Africa: Reg28 Pension flow/ garbage), the high yielders really did outperform!

Another defining factor for FX returns in 2023 was the normalisation of Current accounts post the Ukraine War shock in 2022 on trade balances.. Unfortunately it seems in 2024 there is no clear story here, or any (+/-2%) shifts in CA expected.. And hence will not dwell on this.

Looking ahead, the current narrative for 2024, which I have no doubt will be heavily questioned, is that as the Fed Cuts, you sell DXY… this falls apart in two major ways.

If the fed is cutting, so are other CBs (as is priced)... Interest rate differentials will remain somewhat constant.

IF the fed is cutting <meaningfully>... something is likely ungood.. And I’m not sure that's a world I want to be limit short DXY..

Now of course, a caveat to 1) is that, perhaps we do see some divergence between US / EU / Asian growth in ‘24, in which case you have an economic vol dampener alongside a normalising Fed, and you have a green light to play the FX carry trade..

to 2) its of course more dependent on the risk charateristic, CHF and JPY can easily rally vs USD, but its hard to argue that many others will..

As such I find the arguments for a meaningful USD weakness in 2024 to be somewhat poor, and as such not something I'm currently positioning for... Preferring to think and act like DXY is in a range, and that we are closer to the bottom than the top right now.

So let's look at the current rankings of Global FX, measured by their Carry/Vol ratios. The Usual suspects are clear, much like in 2023… And you can bet the accumulated position in those CCYs is chunky.

(INR a standout, but purely a function that Vol is non-existent and so the denominator really skews things)

Here’s a messy chart again, highlighting how these ratios (for some select ccys) have evolved over the past few years.. And its clear why 2023 was a record year for Carry.. You had not only decade highs in yields, but vols declining too!..

But they have peaked. And looking forward, it's clear that the Carry component will drop, the question will then be how the Volatility side of the equation will develop.

you can easily get a double whammy here, and mostly felt in EMFX..If you get a normalisation in policy rates (see Latam) AND an increase in Vol! Then things will get spicy.

A few expanded observations would suggest that; if 2024 goes south.. Then CEE FX and Latam will be most vulnerable.. MXN and HUF especially. (I will caveat here that the story in MXN is just so powerful (Remittances, Reshoring, Rates) that it will require a <really meaningful> recession to truly whack MXN, but it will be spectacular if it occurs)..

An unwind of the FX carry trade would benefit Asian FX vs CEEMEA/Latam, and will see CNY, JPY outperform.. I suspect 2024 will be continue to be a good year to trade Factor FX models, especially between regions within EM...

One final observation is that the depressed implied vols across FX, and wide interest rate differentials across many pairs, make for very cheap options... If you are inclined to be bullish USD, USDCHF, USDCNH, USDTWD (and USDJPY to lesser extent) calls are cheaper than the forwards ! positive carry / Long vol is a nice combo to have... and within the Bearish USD camp, some HYers (MXN, BRL, INR) offer cheap ways to get long risk.. (ATMF-20df spreads listed)

As we look ahead to 2024, it's evident that one of the defining features of the year will be the series of elections taking place globally. This is not just a series of isolated events, but a significant occurrence where like 4 billion people voting in many of the major economies. This is set to be a major influence on individual countries, and potentially shapes the course of geopolitics and economic trends for a long time ahead..

In EM, elections always take center stage. Investors will be closely watching, waiting for the wave of sell-side analysts promoting narratives of game changing structural reforms and pivotal economic turning points. A more cynical view suggests that while these stories are often surrounded by excitement, they often lead to unrealistic expectations which cannot be met by the flows. Nonetheless, for the spivvy traders, these periods can offer a plethora of trading opportunities, particularly as the RM world get caught up in the whirlpool.

Finally, the US election cycle is gonna start reallly kicking off.. its not as clear as prior elections with regard to the USD / Risk assets (2016, 2020 both clear+binary)... with both sides fiscally irresponsible, its hard to make a strong case either way for now... of course tho, this will change into the election as the market takes sides.

Anyway,

I think that's enough for now... I'm excited for 2024.. markets are a little confused, and that always brings good trading opportunities.. so long as you aren't too stubborn..

Much like 2023, I don't expect a clear narrative to last >2 months (unlike 2021/22). The Market will be desperate to jump again and again into Recession trades at the first moment they can, but perhaps like last year, it just never comes?

As for this blog, I can't imagine it will be consistent or active... Just wanted to write a lil something as I haven't been allowed too for the past 7 years or so.. GLHF

Ok... coming back a few days later to finish this off...I wrote too much and feel sorry for anyone who has made it this far… I’m just gonna write a little one liner with an outlandish prediction for the markets I think about.. not to be taken too seriously

US: Steepeners at risk… Equity pain trade is still for it too just roof higher and higher… The election goes somewhat smoothly but with a Red win but not trump (don't ask me who)

Europe: Multiple Greenshoot narratives keep getting trampled on as the year progresses until Italy just sends it over the cliff… ECB QE restarts here ahead of everywhere else.

UK: Fucked, but at least the Tories will be gone this year.

Japan: The BoJ Hike… but will be guiding cuts by the end of the year again as 25bp base rates kill their economy.

China: Xi bought some time.. Mid cycle rebound, maybe more interesting in 2025 but boy will people try the Long China Short US trade many times this year.

Korea: zzz maybe rates a bit high

India: The Wildcard for a Geopol flare up… But the RBI will manage the FX on both sides.. Can INR print 0 vol??

Czech: CNB will be the first CB to stop cutting, having been slow to start.. when or where that is, idk

Poland : The Tusk hype will disappoint.. Whilst it's the one good political development to occur in ‘23, the flows wont match the story.

Hungary : Hungary just deserves to get punished I’m not even sure why its in the EU at this point..(#HUNGEXIT?), Too many cuts are priced into the curve and the Currency will become vulnerable to something nasty as they make one step too far.

SA: They need to be very careful what side they choose on the global stage.. deep down the election I’m most excited about… ANC to print sub 50% but with no strong oppo, gonna be a fun one.

Israel: Expect the GeoPol to calm down, and the Shekel is structurally cheap!

Turkey: If you’ve been brok’d into TRY or Turkish Assets, I wish you good luck.. I just want to remind you that the windows are normally 6months long before the Erdo Rug .. Its been 3months already.

Egypt: maybe 1yr NDFs >50 a bit high…

Brazil: USDBRL just one big coil.. Should be fun when it breaks but could be a long time away… maybe some spivvy short vol structure (WDKO anyone??) kinda think selic fwds too high too but we know how that usually ends...

Mexico : best fx fundamentals out there… most vulnerable to the downside… is Vol cheap?. .. Banxico can cut a lot more than priced and MXN can get destroyed if the US consumer does crack. Steepeners here look much better than in $..

Chile : quite dull tbh.. Not sure I like the FX tho.

Argentina : I’m just not quite sure how global finance has fallen in love with Millei, has anyone actually listened to him?! This won’t end well..