As it stands, We've had pretty decent payrolls (last 2 month >200k) and a headline U/E rate hit 7% yet very few predict a DecTaper, consensus is for March '14

*Reuters poll on when will the fed announce Tapering

Gold has had a huge offer capping its advance the last week, and likewise in the USTs where the 5's have risen 20bps since I shorted (here), the price action is surely worrying for those expecting no taper.

Furthermore, if we look at the options markets there has been some interesting moves in Implied Vol as we've rolled into the FOMC meeting on the Spot Week contracts

As the contract rolled into encompassing the FOMC meeting yesterday, we saw a large spike in IV, while this is to be expected the move in SW EUR IV as shown above was the largest 1-day % change on a YTD basis, much larger than the September meeting spike and the NFP for Nov.

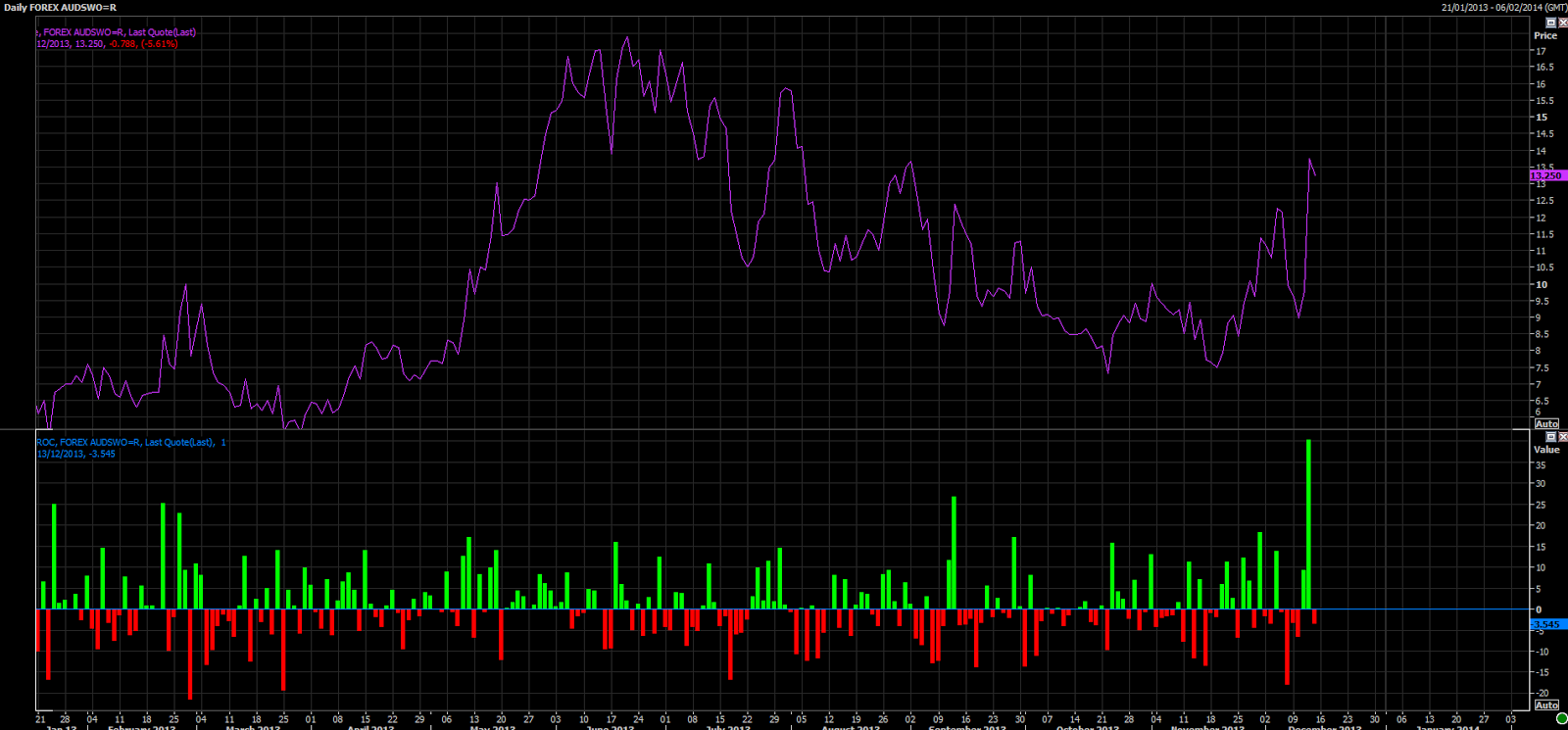

Finally we have the AUD SW ATM IV where we can see the move has been by far the largest so far YTD, and considering the move post Sep FOMC meeting was a swift 1.73% rally, we can see that the market is preparing itself well in advance for some large vol moves. In this instance, the actual IV level is greater than in September, so we can definitely see the options markets are getting concerned about some surprises.

Finally a 3D surface view, we can see the inversion in the term structure quite clearly and this follows out until about 2-3 months, however the Risk reversal skew on the SW is relatively small, therefore suggesting the cost of either a put or a call is somewhat similar showing that there is currently no noticeable bias to market sentiment, if the Put IV > Call IV by more than 2 points then there would be some serious worries but it is not so bad currently.

However, according to Soc Gen traders

"1wk usdmxn paid at 15.5, it's 15/16.5 now. 1wk usdbrl paid at 15.25 and then 15.5, it's 15.2/15.8 now. Rest of the curves are around 0.3-0.4 higher on the day too now

While its not an EM proper AUDUSD also getting lifted - 1m rallied from 9.7 to 10.1 paid and all requests that we are seeing in aud related pairs are buyers"

So we can see that the AUD is being used as a proxy for EM exposure due to its greater liquidity and similar PA characteristics, and all trades being buyers of options suggests that there is a real concern about the volatility that could ensue next week. (remember IV~= the cost of the option).

And from CitiFX

"FOMC event risk priced in the short dates is not fading at all. USD gamma is getting more and more expensive as we approach the event."

We should consider that USDJPY options tend to be the highest volume and most liquid as shown here from DTCC data

All in all, we can't quite yet gauge a proper look at the option expected impact of the FOMC, until the contracts roll into ON and we can look at premiums and costs of ATM straddles etc, but as it stands now, the early protection via options has broadly been largest this year and as such we need to be very careful going into next week.

GL

No comments:

Post a Comment