So following on from my last entry on "fair value" I would post a bunch of varying models for FX pairs. But a quote from Kit Juckes of Soc Gen

"In all FX models, the sensitivity of a pair to any factor changes over time. So people build models, then test them on a sample..."

In other words, the model works at showing the past perfectly, but needs to be constantly adapted for the future. Either way, I've got a few that work pretty well - most include Vol skews, equity perfomance etc and most importantly Rate differentials. R^2's are all above 80, and some even into the 90's suggesting great relationships here.

Most of my models relate to EURUSD but there are some for others and they show the deviation from Actual in a histogram in the second pane.

Firstly - A plain and simple YTD modelled DE2US2 rate implied EURUSD

|

| Green = model. Reuters Eikon |

The simplicity of this model can't be overlooked as short term rates are crucial in pricing FX, and as Schatz and US 2's are so liquid they are a perfect combo to consider.

_________________________________________________________________________________

Next - A medium term Swap fair value model, using 1Y EUR swaps as the basis, this is based over the last 2 years and has a very good tracking ability. This is the easiest tradable equivalent so convergent trades are easy.

Still a very simple model and of course it will be very related, it has both a component of interest rate differentials and EURUSD spot values.

_________________________________________________________________________________

Next - this next one is a composite of the first model, but it incorporates 1 month 25Delta risk reversals, i.e. the skew in the volaitilty between the 25D puts and calls for the one month expiration. A pretty generic indicator of position sentiment and probability of upside/downside.

_______________________________________________________________________________

Next - this one shows the expected 1 year rolling 3M libor differential between US and EURs, basically a derivative of the speed of rate changes between the two, as it stands the rate differential is pretty much 0bps modelled to about 1.32 on the EURUSD. when considering the Dec 2015 contracts though, the interest rate diff is close to 30 bps, but will more likely trade around the June wides of 70-80bps once tapering occurs (especially after ECB rate cut) and as such, once interpolated with current 1 year spread models, the EUR is expected to be trading at ~ 1.26, then in 2015 at 1.17.

This is broadly inline with consensus estimates for 1 Year EURUSD rates

|

| Forecast for EURUSD, bbg |

________________________________________________________________________________

finally - A very long term look at the EURUSD based on the 2005-08 hike period. This one follows well on the day-to-day moves but at a lower relative move. suggesting that in the long run the current variations in the interest rates have little fair value impact on the long term price. But considering the first - we know that they can be used for all time frames.

But because of the l/t nature the deviations are much greater from this fair value.

________________________________________________________________________________

GBPUSD model

Firstly - this one incorporates both Vol skews and interest rate differentials, much like the third one for EURUSD

This YTD model is my main for the GBP, and so far there haven't been any major divergences which is good for the model - bad for trading.

_________________________________________________________________________________

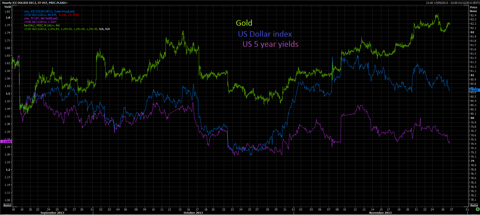

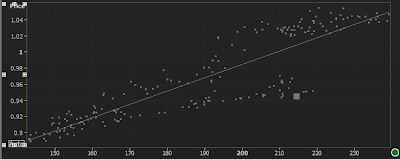

AUDUSD model

This one is far more interesting, the AUDUSD is very sensitive to interest rate differentials, but on the 5yr duration. More on this here

- https://www.dropbox.com/s/hzpoo212ed5q9uu/SG%2520AUD%5B1%5D.pdf

But also, the value of commodities is key, most notably copper. And so I've incorporated both of these into this model and this is the most peculiar of all the models.

this is a longer term model shown over this year and there have been some amazing risk adjusted returns. And as it stands there is a 500 pip deviation in fair value, and considering how easy copper is to trade there is real potential here.

Either way, this is just a few charts quickly put up to show how my models are fairing at the moment, but I'm always adjusting them so they do change.