Firstly, the UK election is now just 2 weeks away and its all starting to get very exciting... or maybe not, I'm not too bothered.. I am finally old enough to vote, however I don't have the best political knowledge and while I have a rough idea on how the election is going to play out, there are plenty of uncertain outcomes that are entirely possible.

We have already seen the markets react to varying polls, just like with the Scottish referendum. After one poll from the Guardian suggesting the Tories had taken a bit of lead we saw an immediate bid in the GBP. This acted as a good sign to me as to where we stand going into May 7th... However currently the bookies (paddy power) favourite is a for Labour Minority. All this uncertainty is what has led to heightened implied volatility in the GBP relative to other currencies as shown below.

|

| GBP-FX composite 1-month implied vol |

|

| GBP riskies vs basket |

So far this year, the GBP has performed well, so long as we don't fund it in USDs or CHF. One of my trades of the year for 2015, was buying a basket against varying currencies and as we can see below that it is up around 10% against 3 of the funding currencies and down 5% against the CHF, so as an update it is all going rather well.

|

| GBP vs CHF/SEK/EUR/AUD |

|

| GBP vs Z5 STIR spread |

Whilst there is uncertainty in this election, and I don't think anyone would disagree with this, its hardly as if there wasn't in 2010. The 1st time we had a coalition must've come at a shock to many, and rightly so the GBP was vulnerable, however only for a day or two.

|

| GBPUSD May 2010 and DXY |

|

| TWI GBP May 2010 |

Now of course I'm not looking to make a prediction of who is going to win... I really don't have a clue, however to me its clear that a fair chunk of risk premium is priced into options markets and spot FX although the past has shown us that even a shock result is necessarily doomsday for the GBP. We have these (imo) outlandish forecasts from the likes of MS, BNPP and barclays seeing the GBPUSD at about 1.4 by Q2 end, not something I really see as too likely unless the USD really gets a kick. In honesty I think the election will most surely result in stupid intra-day vol but in the grand scheme of the GBP (and related to its key drivers) I don't actually see it as too important.

Looking at the BoE/UK economy, sure, we can easily argue that the BoE missed the hike window and now we are pricing in another 14 months (MSM1KE) till we have that elusive 1st hike.

|

| UK PMIs |

|

| GBP 5y5y inflation swap |

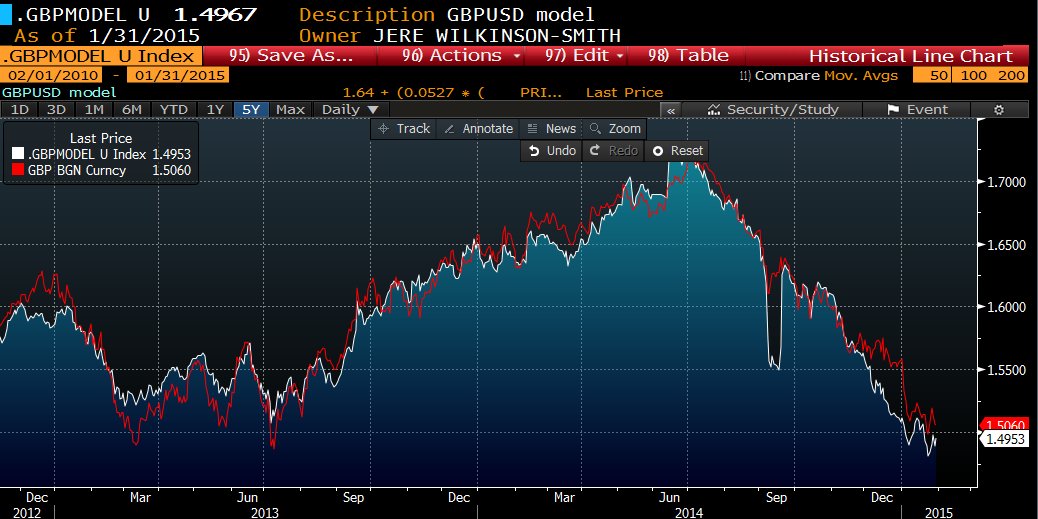

The last time I wrote about the GBP was a couple of month ago and I suggested a 1x2 put spread with spot around 1.54, and the max payout at 1.5... today we stand with spot pretty much at 1.50 and expiration in just over a week I've decided to cover this for a very nice return.

And from here, I'm looking to rotate into a long GBP risk reversal. Long 1.54 calls and short 1.42 puts. The rationale is that if the election passes and the result is acceptable we should see a bid across the GBP and the gap highlighted earlier will likely close. On the other side, even a shock (like 2010 was) may jolt the GBP lower, but it doesn't change the raw fundamental drivers for the GBP at least in the 3 month horizon and given the skew in implied, this structure is pretty much zero cost after fees/spreads.

Now looking at Rates, I've been reading much more on Swaptions, so I decided to look into a possible trade idea here.

|

| EUR and NZD 1yf10Y rates |

Bill Gross came out today and suggested shorting 10Y bunds here, suggesting we could see a 10%-15% return from doing so.. a EUR 10 y swap currently costs about 2bps in carry/roll (mostly roll these days) per 3 months, so while I'm not overly keen on the exact timing its hardly an expensive short. On top of this, if we assume bunds won't go much lower than -0.2% for 10years, which is truly ridiculous given the whole macro situation in my opinion, then price appreciation is limited to a few % at most... so from a risk:reward its starting to make more sense. I've been in a long UST/ short bund trade for a while and its performing okay thus far, however I grow more confident in this, with EUR rates acting as an anchor and any EURUSD dip acting as demand for USTs.

|

| USD -EUR 10s spread |

With this premium, I look to buy receivers in NZD 10s. We currently trade at 3.775 and I think we have the potential to head much lower.

|

| RBNZ 1 year expectations for OCR |

|

| NZD TWI |

The one obvious concern for the RBNZ is house price growth, which would be further fuelled by a move lower in the OCR to say 3%, however I think that this would be worth the benefits.

|

| House price index |

One final quick look is on CAD.

|

| CAD vs Oil |

Given the rationale earlier for the EUR rates, and the recent discussions we've had on European macro and the potential for a strong year, long EUR exposure is something I have been building these past few weeks. EURCAD therefore looks attractive, alongside EURNZD (given the reasons above)

|

| EURCAD |

Anyway, its getting late (/ early...) so thanks for reading, feel free to discuss etc. and if you're in london, do come to the Thalesians talk on global macro next wednesday! should be great!

.PNG)

.PNG)

.PNG)