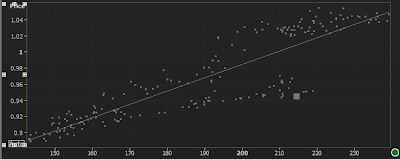

I'll first look at the AUDUSD and will follow the same steps for each FX pair, Firstly here is a chart comparing the AU-US 5 year yield spread to the AUDUSD on an almost YTD look

|

| AUDUSD vs AU5US5 spread |

|

| AUDUSD vs AU-US 5yr spread (bps) |

Using this R^2 value we can create a model and below we can see the spread between the interest rate model and the AUDUSD spot price.

Currently, as seen, the spread stands at around 500 pips, or in other words, the AUDUSD is undervalued by 500 pips to its interest rate model (based only on 5 years spreads). In an ideal world we would position ourselves with a mindset to be in a 5yr tightening trade, while also being in a Long AUDUSD trade - if weighted properly then the trade will be hedged and P/L will be defined by the path of the model below.

Now considering other pairs, I'm going to look at the EURUSD vs the 2 year rate differential we get R^2 of merely 54%, however the price feed has a one month break in data which puts of this value, but the divergence is often so small its not noticeable. However if the 2 year rate spread moves to 25bps the model forecasts a rate of 1.285 for the EUR +/- 150 pips as the fair value level. This is currently far below spot market and as such the EUR potentially could fall very far if short term bund yields drop more.

|

| EURUSD vs US-DE 2 year spread (bps) |

But throughout the period of the model the divergence has moved much further than 100-150 pips from fair value, but currently the EUR is overvalued by around 350 pips to current fair value (which could drop more after ECB cut)

For the GBP, a view that if rate differentials on the 2 year (currently at 10bps) dropped to 0, then the implied fair value would be 1.5252 with a range based on the standard deviation of the model divergence of 1.55-1.500. With the recent tendency of Mean reversion between UK and US rates this is a distinct possibility until Carney backs down somewhat on Fwd guidance, then the mkt expects UK interest rates to race away from US (by race, like 50bps but yeah) and using the current model would see 1.7230 (but the model changes every day based on price changes so it would be dynamic)

Either way, Interest rates are key in pricing FX rates and as such need to be considered at all times, Above calculations have used relatively recent data but the ideal still holds true.