G10 Rates Outlook

- Short L M7 against ERM7 at 131bps, targeting 160/180bps with a stop below 110bps

In recent weeks, and in lieu of a tightenting Fed, GBP rates have seriously outperformed, diverging from a strong link with US rates that has been seen for many years. Growing sentiment regarding the Bank Of England that they will likely be dovish has led to this, with some pushing back the 1st hike to 2017. The divergence away from the Fed, and towards the ECB can be seen below.

|

| Months to 1st hike indexes for Europe, US and the UK |

With the UK economy ticking along very nicely, its interesting to see how the Fed is so much more prepared for a tightening cycle, yes inflation is higher.. but wage growth (at 3% y/y) and subsequent pressure in the UK is greater and with an on average (2.3%) GDP growth it seems fair to start tightening to prevent later pressures.

Unfortunately as is the case with all global central banks, they are placing far too big of an onus on their response to Oil prices, thinking back to the ECB in January, there is almost zero chance we would have seen QE or further easing had Oil stayed at its 2014 levels. But of course, it didn't. And we are now trading $35 or so, and dis-inflationary pressures remain on headline CPI, worse is that the desired "base effects" that were due to roll off in the coming months won't have as strong of an impact on CPI worldwide.

Nevertheless, the UK rates market is pricing in very little tightening, and a very shallow curve, taking this against the backdrop of European rates looks favourable right now. The ECB "shocked" (admittedly against stupid expectations) hawkishly and whilst we saw quite the reaction in front end EUR rates, they will still be firmly anchored from QE flow and negative rates - even being optimistic on Europe, I will still look to receive their rates. Getting into the trade is simply done by selling June 2017 GBP LIBOR futures against EURIBOR futures (L M7 - ERM7)

|

| L M7 - ERM7 |

We've had the "great divergence" between European and US rates, but with UK rates almost 1% from the wides, we have room to move in this direction, as such entered at 131bps, looking for a move towards 160/180bps during the course of the year. We have a relatively well defined stop area in the 110/115bps range.

However as mentioned, its not just against EUR rates where there is a good set-up, but longer out the curve against the US looks good too.

- Short UK 5 year vs US year at 40bps, targeting 10/20bps, stopping at ~50bps

Similar rationale on the UK rates front, the market seems to be seriously discounting any possibility of a hawkish surprise from the BoE, and with the Fed hiking, it will give Carney et al perfect timing to shift tone.

|

| UK vs US 5 year |

More specifically on the 5s, it offers the best relative value against US along the curve, with clear entry and exit levels.

- Recieve AUD 2yr at 2.35%, targeting 2% and risking a move to 2.5%

Australian Rates have moved significantly in recent weeks, against a tide of fundamentals suggesting otherwise. Watching the price action, specifically post the Oct Fed meeting, it seemed A$ rates were being paid along with all $ rates. This offers a good entry point, and opportunity to get long Australia. Domestic data has certainly ticked upwards, with a couple of strong Unemployment reports, but broadly the overall economy remains incredibly vulnerable to a slowdown in China and declining Commodity prices.

|

| AUD 2s vs Iron ore |

Seen clearly above, Iron ore (and the commodity spectrum) has continued to decline aggressively, and whilst the overlay is spurious, the idea is strong. Stevens has told us to "chill" for the Xmas period, but with a worrying China (on the verge of further easing vis a vis CNY weakness), weak economic activity through lower commodity prices and crucially an outperforming AUD that has risen 5-7% (depending on index). This is going to be of most concern going through to the new year and should pressure rates markets.

My base case is that we see further cuts next year as we approach the end of the commodity cycle, possibly bringing the base rate to 1.5%, this gives us more room to target below 2% if this gets going.

This idea plays a further part when considering the FX outlook later on, but broadly, unless we can see a rather sizeable commodity bounce the risks to this trade seem limited to an overly hawkish fed lifting global rates - which seems unlikely.

On to the US curve and the real limportant question is how many times they hike - finsih after fed..

- Short USD 3m5y straddle

|

| US 3m5y implied vol (price vol) |

Given the outlook for the US economy, which does include in my eyes potentially faster than expected inflation and strong growth - but against a world which is easing and arguably in trouble (EMs), I believe the US 5 year will stay fairly well fixed at around the 1.5/2% level that it has traded over the last few years, for the entirety of the next year, and given a 2 month straddle breakevens at 1.32% and 2.12% I feel comfortable selling this (as seen below)

|

| US 5y and 2 month breakeven range |

Lastly for rates, looking at some European rates, and more specifically Sweden. Economically, Sweden is looking good, as does Norway (but oil niggles). With the Riksbank recently changing tone, and shifting upwards the inflation focus as well as growth estimates its possible sweden can surprise us next year - currently the expectations are for lift-off at earliest 2017, more likely 2018 - and not before 2% inflation! but with upward pressure to rates and strength emerging in many G10 core nations then paying rates in some of these less obvious places might work. SEK 1y1y stands at -0.07% and we could see this trade all the way towards 10/20bps with an impulse of inflation and continued optimism in the economy.

|

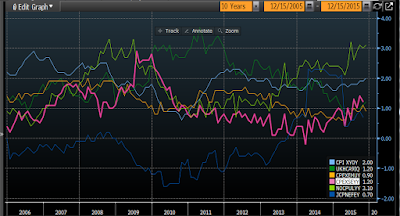

| Core CPI highest -> Lowest, Norway, US, Sweden, UK, Europe, Japan |

Having come from quite serious disinflation/deflation, Sweden has recovered (although its not to say their economy was ever really *bad*) and we could see paying Sweden work out well.

This is unfortunately dependent on what happens in Oil too however, it seems with Oil in this area, we should expect Draghi to lean more towards Easing - even though his, and my own, outlook on the Economy is good. It pushed too far last time, and its possible that if it were to happen again further easing could occur.

This leads to a nice idea in inflation that I've got which is to pay 5y German inflation, which currently trades at 65bps. On the one hand, I am reasonably confident in European and G10 (ex aus/Nz) growth next year, which should place upward pressure on inflation, and if oil continues to stay weak the ECB will likely play with more QE which could stoke the market to price in higher expectations as it did after Jan.

So buying 5y inflation bonds whilst selling 5y govt bonds looks like it could work well. Alternatively, you may not want to sell German 5s as ECB buying may keep it pinned so outright long on 5y inflation bonds also works (but prefer the spread trade).

- Pay German 5yr inflation at 58bps, targeting 100bps, while risking a move to 30bps

FX Outlook:

FX is going to be more difficult I imagine, after 2015 was mostly range bound in the majors, there is very little expectation of *big* moves this year. Implied vols trade at the lower end of the years range, and close to historic means, but significantly above 2014 levels. It's difficult to see with how we are lined up for overall FX market volatility to realize meaningfully higher - after all 2015 we saw plenty of action ranging from CHF de-peg right at the beginning, to wild 5% ZAR swings, and a plethora of emerging market Devaluations.

This last point could remain a key factor going forward and I suspect there will be even greater emphasis from Central banks on their effective exchange rates. China have recently introduced a basket mechanism to diversify away from the USD - this is important as we would expect to naturally see the CNY therefore depreciate going forward, however this is by no means guaranteed especially when considering the basket composition. What this means is it seems less likely that there will be a sharp move in CNH - Current vols stand at 7, which is not to far of the likes of USDJPY or GBPUSD, yet it's likely (as it has done much in the past) realized will underperform as such I would like to sell USDCNH 3m vol here. It implies a daily move of around 0.43% (6.75/sqrt(252))

- Short USDCNH 3m Straddle, delta hedged daily at 6.75%

Vols have tracked Spot higher, but skew remains tight. The main risk to this trade is the idea that PBoC do devalue / let it go.. in which case we would likely trade north of 7, in which case owning a 3m one touch costs around 17% of notional and could serve as a hedge (ignore the delta on it on the overall structure) to our short vol trade.

In G10, as mentioned before, I don't really have a gutsy view on the majors, broadly I'd expect to see the USD under-perform in a backdrop where GBP (due to rates re-adjustment) or Sweden (rates again) could do well but nothing large in terms of move.

So I look to crosses for ideas, and one that I jump straight too is selling Australia and New Zealand. selling these two in a basket against GBP + SEK looks attractive right of the bat, seems fairly cheap and the macro drivers definitely look attractive.

For AUD, the combination of the RBA, and my expectations that their rates continue to drop after being weighed on by the commodity downcycle should result in weakness. Moreover, AUDNZD is well defined in a range and we sit at the bottom end of it, NZ economically is certainly starting to improve, but a continued easing bias from the RBNZ could see pressure especially due to relative strength in recent weeks of the NZD.

On the other hand, for sure the Riksbank don't like a strong SEK, but there is enough breathing room for some mild appreciation. With one of the most impressive economic outlooks, and driving forward alongside Europe suggests the SEK could outperform.

|

| GBPSEK/AUDNZD basket |

Alternatively and a little riskier, would be to short AUDNOK straight out, economically, norway is far better suited to deal with this Commoditiy shock. Not only has the Norges bank preemptively cut, but their domestic demand is showing very strong signs, from the highest Core CPI across G10 to stably strong retail sales. One downside is the impact on unemployment, which has increased in line with oil price declines, however the impact of lower commodity prices has impacted the fiscal balance significantly more, with Norway running a 9% surplus, with Australia's likely to be towards -3% after the Government releases new estimates soon. A similar picture with Current account, with Australia's declining markedly whilst Norways has remained rather strong.

To sum, I like Norway's economy, I believe they are well prepped for this commodity decline and will be well suited to cope, whilst Australia continues to deteriorate, and as such prefer to play AUDNOK from the short side - though I wish FX played alongside the fundamentals they often don't. But with AUDNOK at c6.25

|

| AUDNOK |

There is a lot of relative value commodity determination in this, which is not ideal as I have no firm views on copper against Oil for example.. This is purely a country play, however Oil plays high beta to copper/iron and is marginally less dependent on China so can see an environment where Oil outperforms thus supporting this thesis.

USDCAD is an interesting one, alongside oil prices, the CAD has been absolutely hammered, and is now trading close to extreme long term levels.. much like with Norway, their economy is clearly impacted by Oil, but to this extent? We will have to see, but with USDCAD at 1.40, this could be an out of consensus short that could perform well. But with Oil still dropping its hard to pull the trigger just yet, but it does seem very cheap

Especially given that rate spreads don't support the last 3 months of USDCAD strength and aren't even at their wides

USDCAD is an interesting one, alongside oil prices, the CAD has been absolutely hammered, and is now trading close to extreme long term levels.. much like with Norway, their economy is clearly impacted by Oil, but to this extent? We will have to see, but with USDCAD at 1.40, this could be an out of consensus short that could perform well. But with Oil still dropping its hard to pull the trigger just yet, but it does seem very cheap

|

| USDCAD |

|

| US 5 - CAD 5s |

Emerging markets are an interesting case, broadly they have moved a long way and have priced in the Fed moves fairly well - however when considering sustained commodity price weakness it seems difficult to see a lot of the exporter names rally, and in Asia, with further CNY weakness it would be difficult to see the ADXY index rally meaningfully. Carry is starting to compensate risks such as in turkey and south Africa, but risks seem to high for me personally to step in here, and I would expect basket cases such as Brazil (currently at 3.86) to trade well through 4 again next year.

One of my last trades in FX is mostly a hedge against my underlying biases of a weaker USD and this is to buy a 3m EURUSD 1.07 digi put, which costs around 33% of notional. In lieu of a potentially hawkish and optimistic Fed, and with Oil and these levels once again pressuring the ECB (given how senselessly responsive they are to it) could see a dip back into dovish rhetoric with the ECB concerned about EURUSD close to 1.10 and not parity.. so its seemingly a cheap hedge against this idea to me.

Equity/Credit outlook:

In credit to begin with, the HY space has been in the news a lot recently, but there are many things to consider other than just looking at the ETF HYG, index composition is heavily leaning towards energy/commodity names, and with this space being weak, its no surprise to see these names widen and drag the whole of HY with it. Goldman produced a nice chart (below) which loosely suggests risks of a recession given where HY spreads trade - its more of a nice thought provoking chart, however on twitter/media a lot of the thought has been panicky and shallow.

We need to consider Impacts on default rates when looking at credit, as ultimately that is the key determinant here. Sure, MtM losses on cash bond holding can lead to redemptions -> more weakness especially in lower liquid times, but essentially if you buy these bonds at 7.33% above USTs, unless the default you will be making this. Which is why looking at the CDX HY (credit default swap index of HY debt) the total return this year has outstripped the SPX (on corporate default rates I refer you to a SocGens 2016 credit outlook where they do a great job of analyzing default rates and how they are unlikely to spike here )

With the positive outlook from the Fed, and strong corporate growth in the US, I see at least for H1 a positive return in the high yield class. A goldilocks fed should spark risk on, with acceptance of a strong economy but also remaining accommodative enough to support growth.

CDX HY trades at 485 as I type, and a synthetic forward trades at 555bps or so (6 months) on the s25. Selling protection at this level looks attractive, but even more so is selling payers given the huge implied pick up. A 3 month (cant get liquidity further out) 525 payer breakevens at 580. I would use this premium to source trades in other spaces. Cash HY is likely to outperform on a bounce in risk so using this 65bps to fund HYG calls could work well, or just run with the short payer anyway.

European equity has underperformed US in recent weeks, although is set up with much more favorable terms with the ECB potentially embarking on more easing (not my base case but possible) and economic growth to see definite upside could result in strong corporate returns and a strong eurostoxx. Same in Japan, looking at the economy here, its doing well - recent Tankan data was robust, labor market tightening is accelerating (jobs-applicant ratio at 1990 levels), continued accommodation from the BoJ (however no more extensions to this). Nikkei likely to reach new swing highs over 21,000.

Although I don't have strong convictions in equity space, and these are consensus views that I agree with, however in US equity, I struggle to much upside and would continue to sell vol here. Dips will likely remain well supported throughout the year, and we will inevitably reach some point where we've dropped 5% in a few days and the media starts to panic, the skew widens considerably and the VIX term structure inverts - but as things stand these continue to present buying opportunities with the US economy performing well.

Either way, just some of my thoughts on financial markets through 2016, it does seem to be setting up to be interesting and I wish you all good luck - oh and disclaimer, don't listen to anything I say here, it'll probably all be wrong!

Happy Christmas Readers

One of my last trades in FX is mostly a hedge against my underlying biases of a weaker USD and this is to buy a 3m EURUSD 1.07 digi put, which costs around 33% of notional. In lieu of a potentially hawkish and optimistic Fed, and with Oil and these levels once again pressuring the ECB (given how senselessly responsive they are to it) could see a dip back into dovish rhetoric with the ECB concerned about EURUSD close to 1.10 and not parity.. so its seemingly a cheap hedge against this idea to me.

Equity/Credit outlook:

In credit to begin with, the HY space has been in the news a lot recently, but there are many things to consider other than just looking at the ETF HYG, index composition is heavily leaning towards energy/commodity names, and with this space being weak, its no surprise to see these names widen and drag the whole of HY with it. Goldman produced a nice chart (below) which loosely suggests risks of a recession given where HY spreads trade - its more of a nice thought provoking chart, however on twitter/media a lot of the thought has been panicky and shallow.

We need to consider Impacts on default rates when looking at credit, as ultimately that is the key determinant here. Sure, MtM losses on cash bond holding can lead to redemptions -> more weakness especially in lower liquid times, but essentially if you buy these bonds at 7.33% above USTs, unless the default you will be making this. Which is why looking at the CDX HY (credit default swap index of HY debt) the total return this year has outstripped the SPX (on corporate default rates I refer you to a SocGens 2016 credit outlook where they do a great job of analyzing default rates and how they are unlikely to spike here )

With the positive outlook from the Fed, and strong corporate growth in the US, I see at least for H1 a positive return in the high yield class. A goldilocks fed should spark risk on, with acceptance of a strong economy but also remaining accommodative enough to support growth.

CDX HY trades at 485 as I type, and a synthetic forward trades at 555bps or so (6 months) on the s25. Selling protection at this level looks attractive, but even more so is selling payers given the huge implied pick up. A 3 month (cant get liquidity further out) 525 payer breakevens at 580. I would use this premium to source trades in other spaces. Cash HY is likely to outperform on a bounce in risk so using this 65bps to fund HYG calls could work well, or just run with the short payer anyway.

- Sell protection in HY US credit via a 525 payer for 65bps

- Long Eurostoxx and Nikkei against US at index level 100, targeting 15% outperformance

|

| ES vs VG |

Although I don't have strong convictions in equity space, and these are consensus views that I agree with, however in US equity, I struggle to much upside and would continue to sell vol here. Dips will likely remain well supported throughout the year, and we will inevitably reach some point where we've dropped 5% in a few days and the media starts to panic, the skew widens considerably and the VIX term structure inverts - but as things stand these continue to present buying opportunities with the US economy performing well.

Either way, just some of my thoughts on financial markets through 2016, it does seem to be setting up to be interesting and I wish you all good luck - oh and disclaimer, don't listen to anything I say here, it'll probably all be wrong!

Happy Christmas Readers