What is still being banked on across the financial markets, especially FX is the divergence of monetary policy, most clearyl visualized with the 1y1y USD and EUR rates charts as below.

.PNG) |

| USD vs EUR 1y1yf rates |

If we look at 5y5y rates, a basic proxy for terminal rates we can see that, yes while USD and GBP rates are higher, they are being dragged lower by those of Europe etc.

.PNG) |

| USD, GBP and EUR 5y5yf rates |

But bringing it back to central bank rhetoric, the FOMC mentioned how it has increased its attention of international developments, be it economic data or policy. As such, while the short end may still be chasing this dream of a 2015 divergence, in reality it may be far harder than we first thought.

There has been an uptick in market expectations for inflation across the world, and this seems simply as the last hurdle to overcome before we have hikes, however given the recent central bank action, I am finding it harder and harder to believe the Fed will (or even can) hike rates this summer, with Sept/Dec being far more likely to me.

However this, I think, is probably a transitory reaction function to global central banks - and the fundamentals still remain in tact, so a later / faster hiking cycle is what I look for.

Short sterling vs ED curve

However, given the fundamental picture that remains in both countries, with strong labour markets / growth prospects and wages being the key drawback - steepeners on both I believe will work. However timing this is key, because so long as people are receiving the long end, this curve will get flatter and flatter, and right now everyone and their dog is loving duration (with good reason), however this a different trade that is just being pushed in the same direction by the flow.

So I've so far argued that the US is less likely to hike given the RoW, but at the same time suggested a steepener.. hmm... contradictory, but like I said, not entering just yet...

|

| Short sterling curve vs 6mo ago |

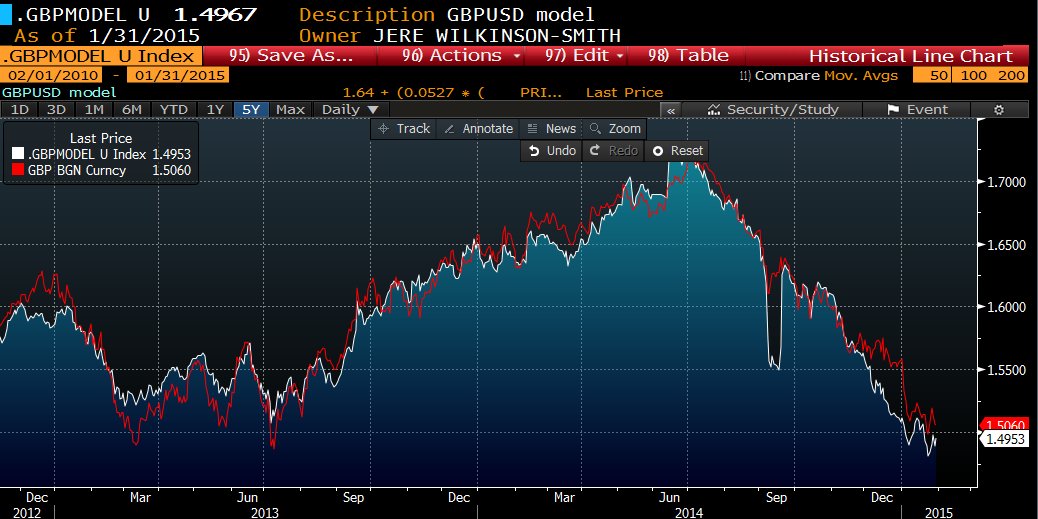

In FX land, the GBP is still being ruled by rate spreads, in a model with variables that haven't been updated in a year now, and still going strong. The biggest variable in this is the 1y1y spread.

|

| GBP vs model FV |

I like this chart a lot, as one would expect the ccy weakens into the announcement, but in 3 of 4 cases (this doesn't include GBP, which in 2012 also rallied post BoE) the currency started to appreciate over the coming couple of months.

|

| EUR-US CESI and EU/US equity ratio |

On top of this we see the relative equity performance between Europe and the US, which might result in EUR inflows which was a major factor supporting the EUR in the 2012/14 rally.

So the EUR... reasonably cheap right now, but it is still dangerous to short the USD even if it is getting (wayyyyy) ahead of itself. But 1.20 seems possible to me.

.PNG) |

| JPY vs nikkei |

The Bank of Canada shocked us all with a rate cut, though in hindsight, much like Norway seems to make sense with weakening fundamentals and the immense drag of drastically lower (and still falling) oil prices. The CAD has reacted as expected, but it's not something I am willing to to fade, as against rate spreads its perfectly fair.

However, looking at the AUD, we've a tad divergence occuring. In this case the long standing correlation between AUDUSD and 5yr us real rates

Has suddenly diverged...

AUD rates has been heading lower, with the market definitely pricing in rate cuts from the RBA, the recent rhetoric from the RBNZ has flipped from hawkish to perfectly neutral with the 90 day bank bill futures curve flat out through 2017 at 3.5%

It would not overly surprise me to see a rate cut from the RBA, but house price growth is a big consideration here, in any case, vis a vis the USD and JPY I do think that the AUD is getting to be decent value especially as this divergence highlighted above grows... AUDNZD is still a favourite of mine.

Finally a little bit on EMFX, not my strong point, but noticing a few differences in the recent sell-off as opposed to older ones. Spot EMFX is trading lows (as per JPM index), and especially noticeable weakness in TRY / MXN. However, looking at rates, most likely due to the drop in global inflation / core DM rates, we've seen Turkey, SA rates drop meaningfully etc, but unlike other times, the demand in bonds is not at all reflected in a strong ccy.

|

| USDTRY vs 10s |

A similar picture in South Africa,

|

| $ZAR vs 10s |

But when considering that there has been a global pick up in vol, comparing to G10 vol composite, CNH vol is in fact near the lows, and with high carry looks to be attractive. Whether we look to buy spot or take advantage of high implieds / riskies.

There has been discussion of a widening of the trading band from fix +/- 2% to maybe 3% as china looks to float the currency a bit more, but for the meantime, with spot at low levels vs the USD and on a vol adjusted carry basis, CNH looks aight.

Anyway, quick one from me today, been busy at uni... some contradictory trades to themes, but timing as ever is key blah blah blah.