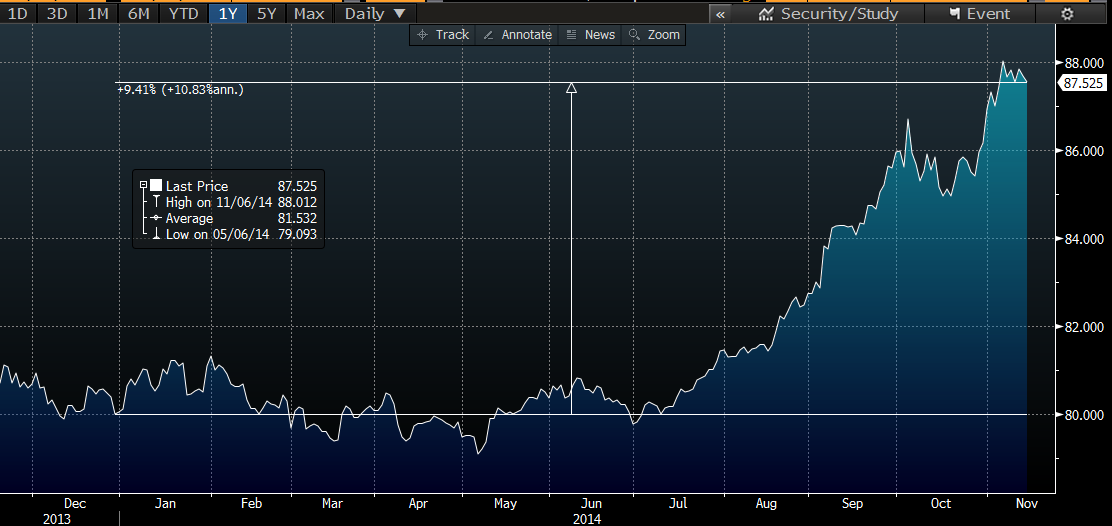

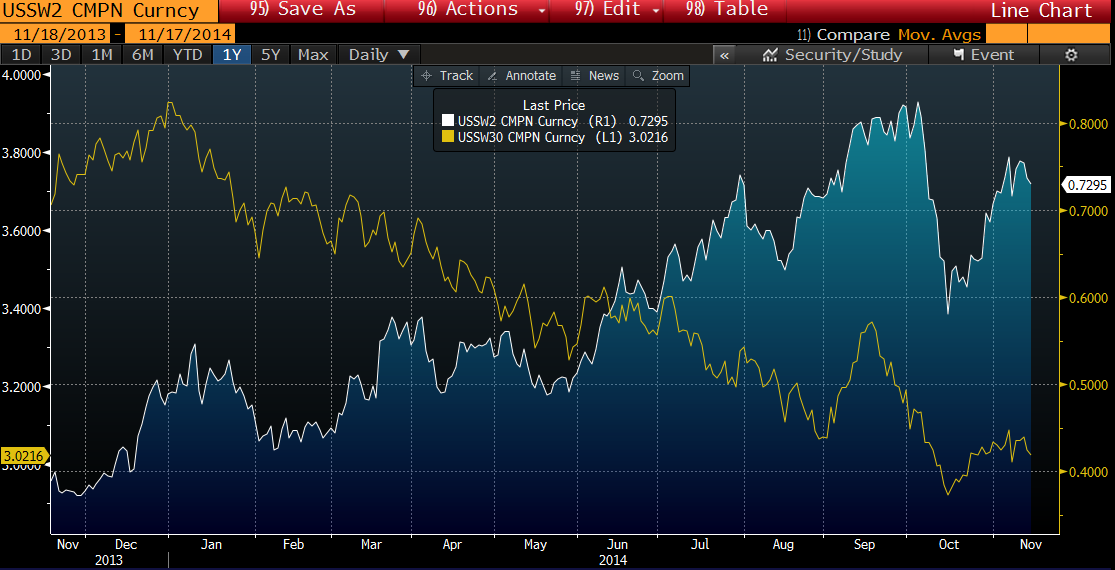

2014 was an odd year, I can clearly remember reading through all the yearly outlook pieces and there were two distinct themes... Long the USD and position for higher US interest rates. In a sense then, we've seen a nice mix, the USD did infact rise, as pretty much everyone expected (fig 1), however US rates - no matter how we look at it underperformed expectations. Whether we are looking at the short end, where rates didn't manage to rise above the forwards or the long end where we saw quite the drop in rates, pretty much no one called it. (fig 2)

|

| figure 1 |

The Dollar index is currently up 9.5% for the year, however it did take its time, for the first 6 months it was completely flat

|

| Figure 2 |

Flattening of the yield curve was a big theme this year, with 30s dropping almost 100 bps, and the short end rising close to 40bps on the 2s

|

| G10 returns vis a vis the USD (carry adjusted) fig 3 |

Overall, the ARS performed best even after a spot devaluation (just goes to show how powerful carry is!) followed by India. In last place, unsurprisingly... Russia.

|

| figure 4 |

|

| fig 5 |

Global monetary policy divergence was really the theme last year, but frankly this seems to be the main talking point for 2015 too.

Figure 5 is my favourite chart to explain 2014, 1y1y in EUR and USD.

However this time we have the potential for a few more risks to the global economy ranging from China to continued disinflation.

Geopolitical risks were also evident this year, primarily focused on Russia and the Middle east, one of my favourite spurious correlation charts is that of Russian CDS' against DAX. Whilst somewhat spurious, there is something behind it.

|

| russia CDS vs DAX, fig 6 |

2015 outlook - FX ideas

#1 Long NOKSEK

I've been talking about the NOKSEK quite a bit on twitter recently.

Currently, in the NOK rates market there is a small probability of rate cuts from the Norges bank As per fig 7, whilst the Riksbank still struggles with Deflation.

|

| Fig 7 |

|

| Figure 8 |

When loading up the NOKSEK against 2 year swap spread, we've seen quite the divergence in the past few months, mostly Oil related.

|

| Figure 9 |

For the NOK to outperform, we are going to need to see Oil stabilise in the medium run. We've seen a pick-up in the correlation between traditional commodity currencies and their respective important commodities. This also heavily impacts Norway's Terms of Trade, which whilst lower, does not justify the extreme weakness in NOK as we can see in Figure 10 with Norway's ToT overlay against the NOK

|

| Figure 10 |

So, I expect the NOK to outperform the majority of the G10 next year, but specifically against the SEK where we are likely to continue to see extreme Riksbank rhetoric, with the likelihood that market expectations of a hike get pushed back some years. As such, funding in SEK seems like a good pair trade.

Lastly, from a technical perspective, currently entry levels seem reasonably attractive, looking for a move towards the 1.15 area

#2 Short Eurodollars

A very popular trade in 2014... positioning for higher US rates. Currently, according to Fed funds futures (complied by MS into time to 1st hike) we are still expected to wait to Q3 2015, even though most economists still expect it to arrive in Q2.

This trade is not based upon the dot plot, I've covered my thoughts on that in the past, but I firmly believe the US economic growth story is pretty good, whether we look at PMIs and their momentum, or more broadly at the labor market, nearly everything is promising. The only drawback, much like the UK, is the lack of inflation - specifically wage inflation.

My trade is to position for higher short end rates, using an option structure as below.

|

| Fig 11 &12 |

I'm looking at EDM6, or June 2016 Eurodollar futures, currently trading at 98.69, buying downside puts funded by selling upside calls brings in small premium over the 1y trade, with a breakeven point at 98.75 (at expiration) as can be seen on figure 12

|

| Fig 12 |

#3 Long GBP basket

When looking at UK rates, we've seen quite a drop in BoE expectations. At one point, there was some discussion about a 2014 rate hike, clearly that hasn't occurred, so its all about when in 2015. Given the macro-economic backdrop (aside from wage inflation) would suggest to me a Q1/Q2 hike, but looking at the current short sterling curve... and the move in the past few months we expect a Q2/Q3 hike. Therefore there is room, in my opinion, for there to be upward pressures to rate hike and the curve.

|

| Short Sterling Curve - fig 13 |

|

| fig 14 |

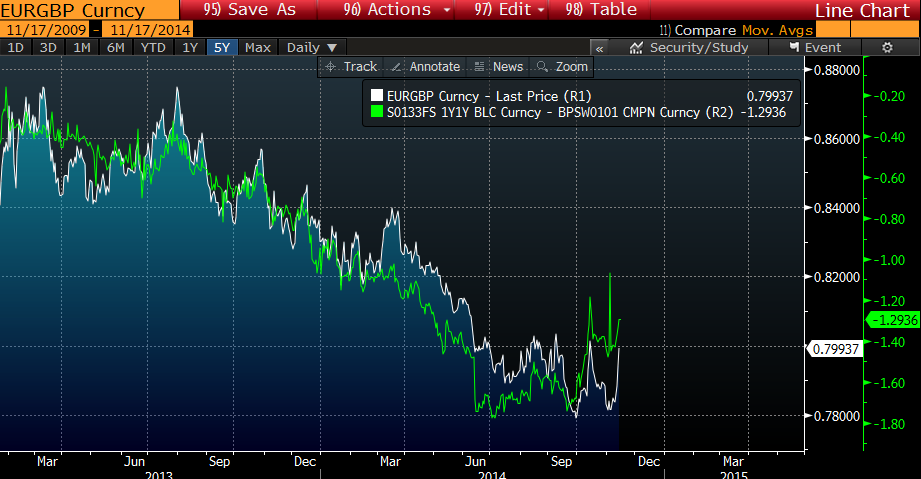

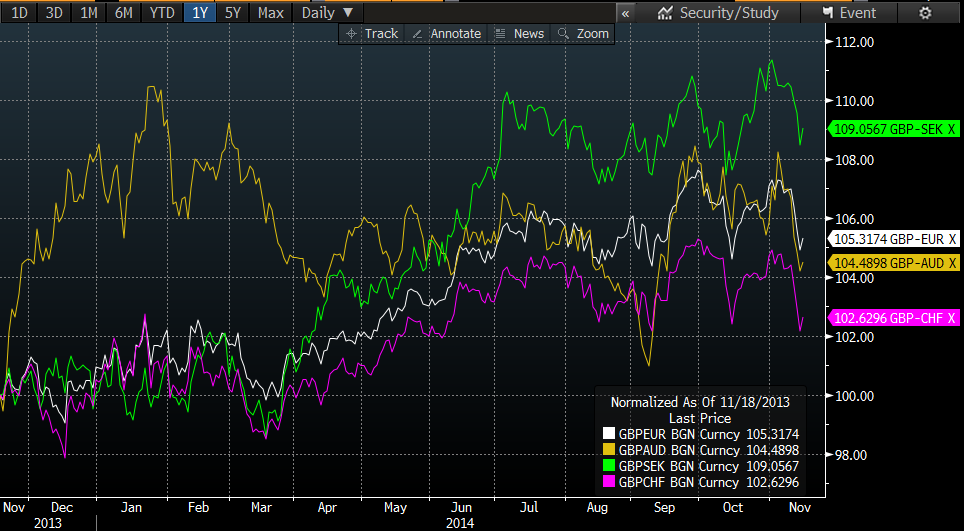

There is no doubt the UK economy has lost some of the momentum that it had in late 2013 / early 2014, but even after that, the macro picture is doing well and as such I expect to see the GBP outperform throughout 2015. Currently, when you consider it against Non-USD pairs, the GBP is quite high.

EURGBP shorts still seem like a good idea, however I would like to sell at better levels. Currently, the EURGBP is a little cheap to rate spreads as per fig 15, so we may see some strength with which to sell into.

|

| Figure 15 |

|

| figure 16 |

Furthermore, Long a spot basket against CHF/EUR/AUD/SEK

|

| figure 17 |

The BoE is likely to be less dovish than what some expect, and combined with a strong UK economy, I expect to see GBP out-performance.

Theme #1 Oil prices

As I've discussed previously, commodity prices are likely to be a big factor throughout 2015, as they have been in the past few months. There is a strong chance that central banks will pay close attention to developments in oil prices specifically.

|

| Figure 18 |

Figure 18 shows the USD (inverted), oil prices and US inflation swaps. Whilst I am unsure on the full cause of the major drop in oil, there some clear rationales... Weaker global demand / higher Oil supplies and of course a higher USD can sum up the move lower this past year.

The impact on inflation, and possibly more importantly inflation expectations from a decline in oil prices will likely drive global monetary policy, and with the current disinflationary trends, a decline in commodity prices, at least to me, seems like one of the biggest potential risks to any central bank hikes next year. Especially from the Fed where Yellen seems intent on finding an excuse not to hike, after all, she can keep saying data-dependent and can justify no hikes any time soon.

Theme #2 China

Chinese 2015 GDP forecasts (fig 19) have consistently been downgraded over the past year, currently seen at 7%, however there is a good risk that this could be much lower into the 6 handle.

|

| Figure 19 |

The most obvious impact from a slowdown in China is for the AUD... As we can see in figure 20 Australia's terms of trade is at its lowest in 10 years, which will certainly weigh as we move forward into the next year.

|

| figure 20 |

When we look at Iron ore prices, its clear that there has to be some weakness within china (being the biggest importer) and this has, and will weigh on the AUD assuming that we actually the weakness that is to be expected. while currently there are no rate changes priced into the AUD rate curve over the next 12 months, but if the mining slow down continues, and house price inflation is lower, then we could definitely see the RBA err muc more to the dovish side. In this given scenario, I would expect the AUD to trade lower towards 0.80 and below.

On the other hand, what if the PBoC / china does something... RRR cut? some sort of stimulus package? well, maybe... however, as China moves towards a more consumption orientated economy GDP growth will be structurally lower, so China may not need to be concerned with the current decrease in growth. Given this potential for Chinese intervention, a possibility for US rates to pushed back and then of course Australian debt offering quite the yield premium for AAA, then AUD would seem like a popular currency, especially on a sovereign/ cen bank diversification basis.

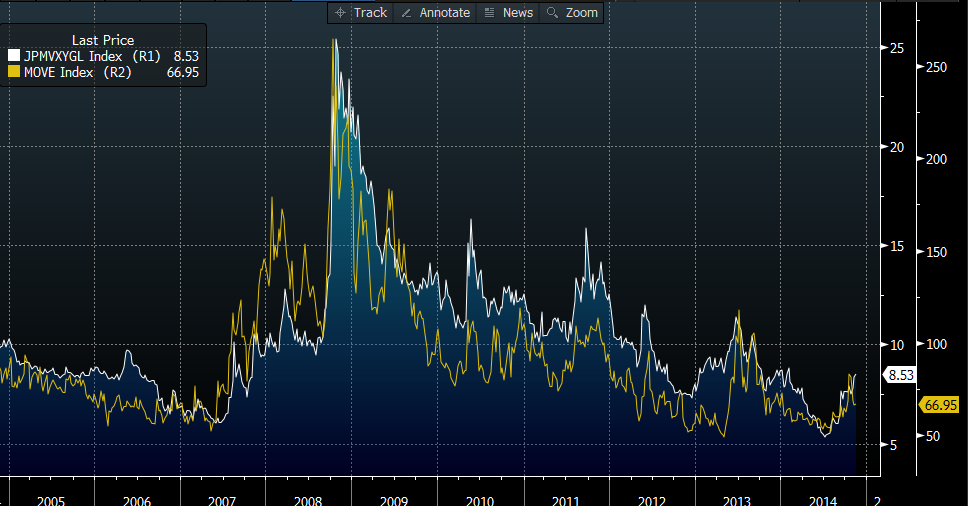

Volatility has historically tracked the USD, mostly given the "safe haven" aspect, however this time is not the case.

|

| figure 21 |

It's clear the USD is starting to react to the Fed hike chances, and we are likely going to see a pick up in volatility in the event of Fed hikes. I would therefore expect to see greater intra-day volatility throughout 2015, however I could bet that last year, people were saying the same about 2014... and that clearly didn't materialize. So whilst I expect a pick-up, I'm not going to be looking to buy vol, I'd much prefer to adjust my risks accordingly, maybe spend more time taking advantage of intra-day swings, but we will see how it goes.

|

| figure 22 |