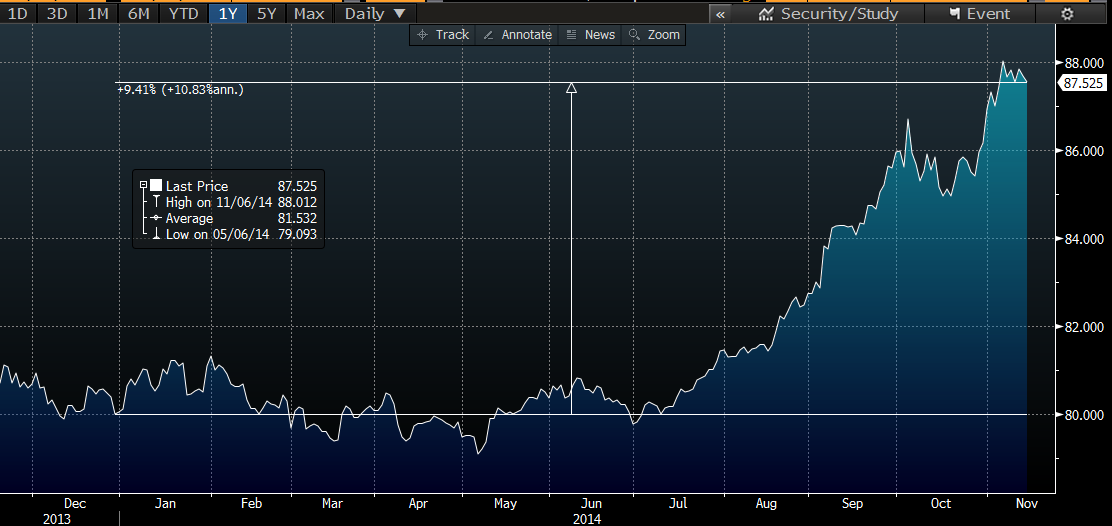

However, there has been a lot of discussion around the impact of oil on monetary policy, an idea I brought up in my 2015 outlook last month. There is no denying that at 40% fall in the price of oil will bring about lower inflation, and the market expectations (as per 2 year $ CPI swaps) show this relationship clearly.

The Fed knows this, the Fed can see this, but should the Fed actually care? no.

Yes, there will be a drop in CPI next year, whether the impact is as large as what the market expects is yet to be seen, but *if* CPI is below 1% and approaching 0%, does anyone actually think the fed will hike rates.. probably not. But at the same time, this drop in production costs, a supply side issue, should be of benefit to the US economy, and the impact on inflation should be short term at most...

But then explain to me why longer dated inflation expectations are cratering too, I can see the argument for oil impacting very near term inflation... but 10 years? 30 years? certainly not.

70bps is a lot, and it does time well with the oil price decline, but I still think there needs to be something else at play here. Something that the Fed should care about? well okay, maybe not, I just think its interesting and worthy of note to see that its not just near term inflation expectations that have been tanking.

Either way, this is probably a small issue - more pressing issues lean on the side of a hawkish fed and we can talk about dots and FF futures all day long but that probably won't achieve much. But in the last 6 months we've seen quite a drop in rate expectations, whilst at the same time the US economic story has hardly worsened.

Personally though, I do think there is room for, even if it isn't directly warranted, for a moderately dovish Fed. Looking at EURUSD techs below, we can see that the EUR has found support with oscillators turning up and a recent bullish engulfing candle there is potential for a further squeeze higher next week on the chance of a dovish fed.

However, I am looking for these opportunities to sell higher, given that the macro fundamentals of a likely ECB QE and further rising of US short rates should still lead to a lower EURUSD over the medium run. Looking to sell 1.2660 if we get there.

Same sort of picture in Cable actually, from a technical perspective it looks like we could see a rebound, though this might be more a USD thing rather than a GBP one.

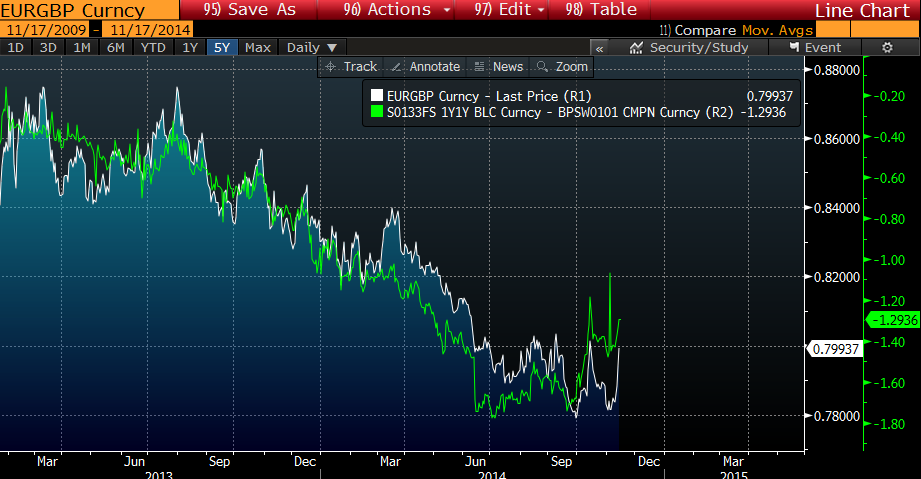

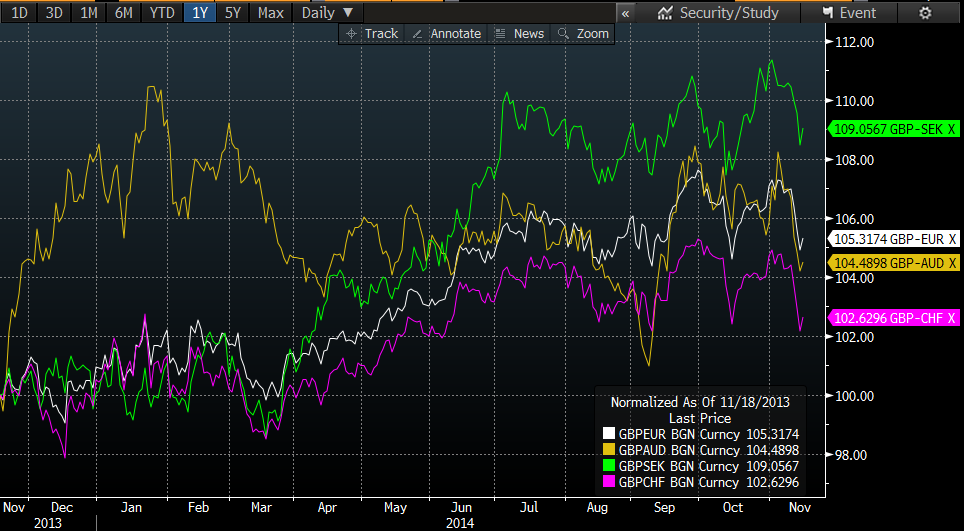

And looking at the drivers of the GBP, it still is being run by short end rate differentials, thus correctly looking at the relative macro pictures it should be easy to play the cable.

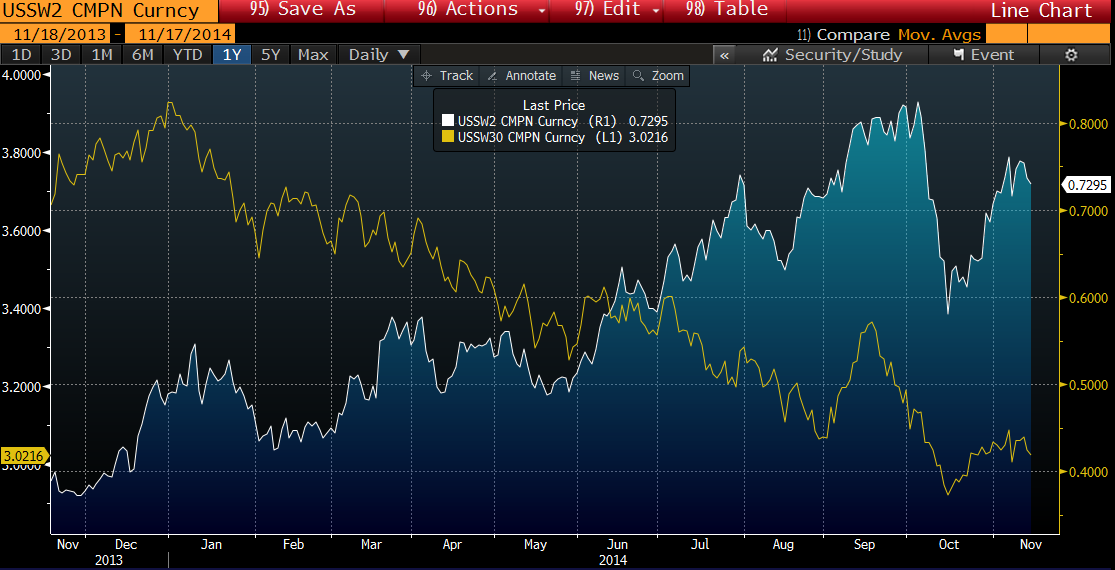

Here we can see the difference between Z5 Short term interest rate futures, and its clear to see the importance, and for the first time in over a year US 3m expectations for dec '15 where higher than the UKs.

Here we can see the rolling sum of Citigroup's Economic surprise indexes for both the UK (red) and the US (purple), in the past 4-5 months we've seen quite the divergence with US activity picking up and UK slowing down somewhat. However when looking at the overall level, the UK economy is no worse than that of the US in my opinion. Whether we are looking at the labour market or PMIs both are performing admirably and above that of the ROW

Furthermore, any potential shocks from Oil and its impact on monetary policy should be relatively neutral between the two economies so should not really be important.

Just 6 months ago, the crossover between Eurodollar futures and short sterlings occured in Dec '17, however today its Dec '15, a huge underperformance by the UK, clearly shown in the cable's decline, however what I'm suggesting is that its unlikely to see a further fall in UK rates relative to US, given the relative macro picture, as such I'd expect us to be range bound between 1.55/1.60 until we get a new situation.

Another theme developing in G10 fx is that going on in Australia.

The OIS market has started to price in some rate action from the RBA over the next 12 months, specifically pricing in 30bps of cuts. With a record decline in Terms of Trade, continuing commodity price weakness and concerns from China its clear to see why. Many investors have jumped on the Recieve AUD rates bandwagon, which makes sense. But in terms of the AUD itself, I wonder to myself how much Australia and their fundamentals really matter to the long term picture of the AUD.

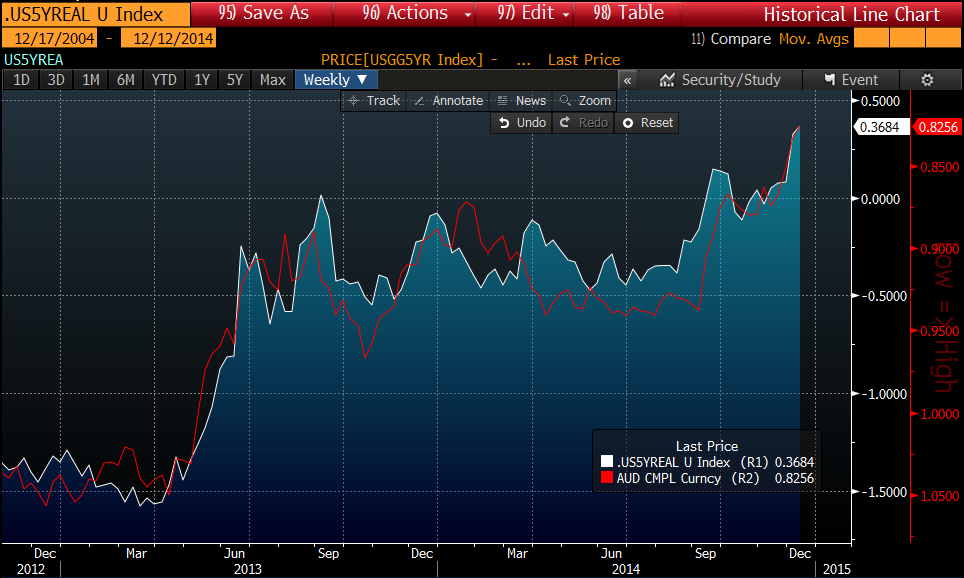

We can see the AUD (inverted) against US 5 year real rates, a very strong relationship, and with AUD still being considered a "high yielder" in the G10 space, a pickup in US rates is going to hit the A$ as we've seen. US 5 year real rates have picked up in the past few weeks due to the impact on breakevens from the oil price decline, as nominal rates have only headed lower/sideways. So once again, there is an argument to be made for the AUD to outperform *if* oil prices bounce.

Here we have a chart of US HY OAS for the energy sector, the spread is just shy of 1000bps currently, under-performing the market massively as oil prices drop and volatility (green) picks up.

This has been cited as the main reason for the Equity declines in the past week (just check the FTSE), as we've got the back and forth discussion on "are lower oil prices good or bad?" now I've read a few sides, mostly I see it as good, but I can see that such a sharp, sizeable drop can in fact be detrimental by completely killing investment in the energy sector for the mean time - though the benefits, at least for the US / UK still outweigh in my opinion, and as such dips in equity / HY should be looked at as decent opportunities.